After WAW’s Story, CBN Begins Investigation Into Unity Bank Fraud

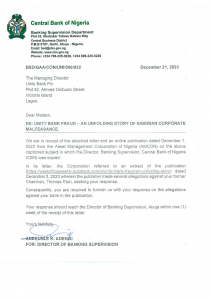

The Central Bank of Nigeria’s Banking Supervision Department Director, Mr Adekunle Adeniji, on 21st December, issued a response in acknowl...

The Central Bank of Nigeria’s Banking Supervision Department Director, Mr Adekunle Adeniji, on 21st December, issued a response in acknowledgement of the Asset Management Corporation of Nigeria (AMCON) letter forwarded with receipts from West Africa Weekly’s story, as it uncovered the corporate malfeasance in one of the Nigerian banking sector — Unity Bank Fraud.

Considering the regulatory body’s inaction might be creating a loophole in the banking system, this evidence-based report has led to the CBN’s recent move to look into Unity Bank Plc — a commercial bank which the very rich man, Thomas Etu, in 2015 – 2017 once chaired as Board of Directors.

However, with ownership to stakes in many multi-billion Naira conglomerates, as West Africa Weekly earlier reported, Thomas Etu stands to witness an Apex Bank investigation with possible invites from the NDIC and EFCC at a moment’s notice as CBN’s investigations commence.

After referencing the unfolding story, CBN, in part of the letter, stated clearly to the Unity Bank Branch in Victoria Island, Lagos: “Consequently, you are required to furnish us with your response on the allegations against your bank in the publication.”

Also, it states, “Your response should reach the Director of Banking Supervision, Abuja within one (1) week of the receipt of this letter.”

Regulatory Body Investigation

Meanwhile, it is worthy of note that an investigation into Unity Bank fraud is a chance to protect public interests and answers, which the purpose of this exposé must achieve.

These questions would interest the Nigeria Deposit Insurance Corporation (NDIC), whose sole purpose of existence is to protect public bank deposits as a financial risk minimizer and the anti-graft agency, EFCC, to help the public interest here:

What is the exact value of insider Non-Performing Loans covered up in the sale to Frontier Capital?

Why was the N13bn fraud by the Treasurer covered up, and why were the recommendations of the committee never implemented?

Why and how has Unity Bank continued to operate with negative shareholder funds to date?

What is the role of the auditor in keeping this fraud going?

What is the true status of the new loans granted to Thomas Etuh by Unity Bank? Have they become NPLs?

Are there other directors of Unity Bank who are beneficiaries of these loans to Thomas Etuh, which is an incentive for their continued breach of the regulatory limit on insider loans?